How To Subtract Hst From Total

Right click and then click Copy or press CTRL c. HST does not apply to most resale homes.

Mathematics For Work And Everyday Life

If 112 then original was 100.

How to subtract hst from total. If X then original was. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. If the sales tax rate is 725 divide the sales taxable receipts by 10725.

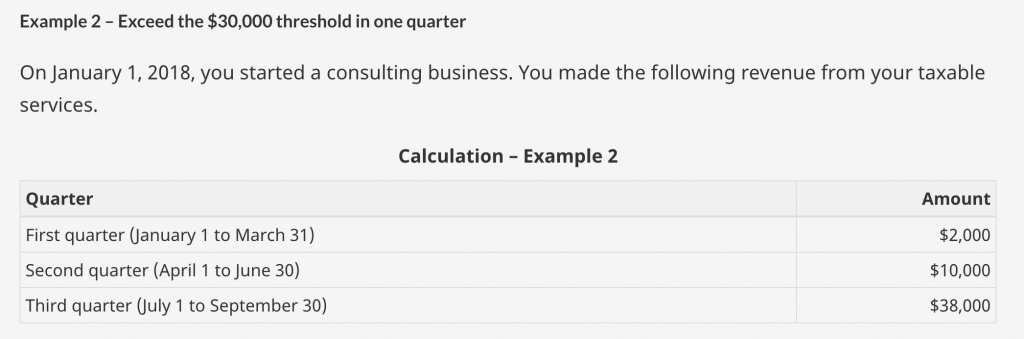

Forest Hill Real Estate 9001 Dufferin Street Unit A9 Vaughan Ontario. Multiply the result from step one by the tax rate to get the dollars of tax. In 1997 Harmonized Sales Tax HST was introduced in three provinces New Brunswick Newfoundland and Labrador and Nova Scotia.

14 rows Total before tax. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Current HST GST and PST rates table of 2021.

115 X 3 23 15 GST. This is your bill without GST. Take the total price and divide it by one plus the tax rate.

100112X which is the same as 1112X. See the articleTax rate for all canadian remain the same as in 2017. Download the Free Sales Tax Decalculator Template.

Then you add up the GST and HST you paid on allowable business expenses called your input tax credits ITCs and subtract that amount from the total GST and HST you collected from customers. Or more generally 1 1tax X. This is the provincial tax.

Substitute the cells containing the tax and the total price in the above formula. In 2013 Prince Edward Island Prince Edward Island harmonized its PST Provincial Sales Tax with the GST Goods and Services Tax to implement the HST. For example since 700 - 625 - 3125 4375.

For example select cell C1. That means the total sales for hot food -- not including sales tax -- is 10000 divided by 108 or 9259. Tushar Mehta MVP Excel 2000-2015 Excel and PowerPoint tutorials and add-ins.

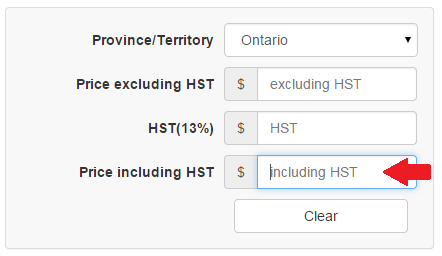

Amount with sales tax 1 HST rate100 Amount without sales tax. Working backwards to find the GST and GST exclusive amounts from the total GST inclusive price. So if you paid 2675 in total for two books and you know from looking at the receipt that 175 of.

Subtract your bill without GST from Step 2 from the bill for. In the example if your bill including GST was 229 then 229 divided by 105 equals 21810. This gives you the pre-tax price of the item.

You have a total price with HST included and want to find out a price without Harmonized Sales Tax. It is very easy to use it. Lets imagine that you paid 2675 in total for two books and you know from looking at the receipt that 175 of that was the tax.

Subtract the Tax Paid From the Total Subtract the amount of tax you paid from the total post-tax price of the item. In 2010 HST was implemented in Ontario and British Columbia. Inland Revenue IRD recommends the following formula to find the GST amount from a GST inclusive price.

To work out the GST exclusive amount simply subtract the GST from the GST inclusive amount to get the original GST. Formula for reverse calculating HST in Ontario. The first thing you need to do to calculate sales tax backwards is to subtract the amount of tax that you paid for the product from the total price that you paid.

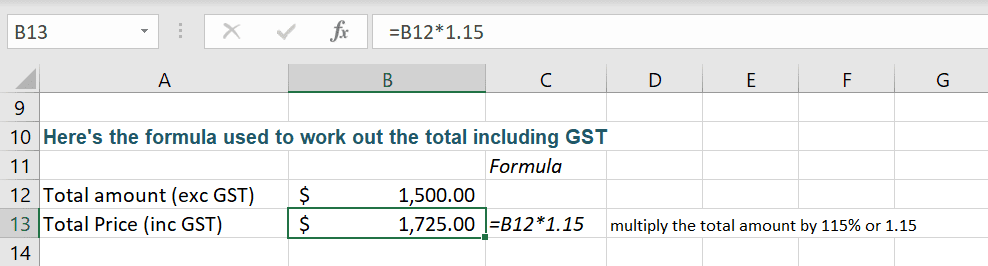

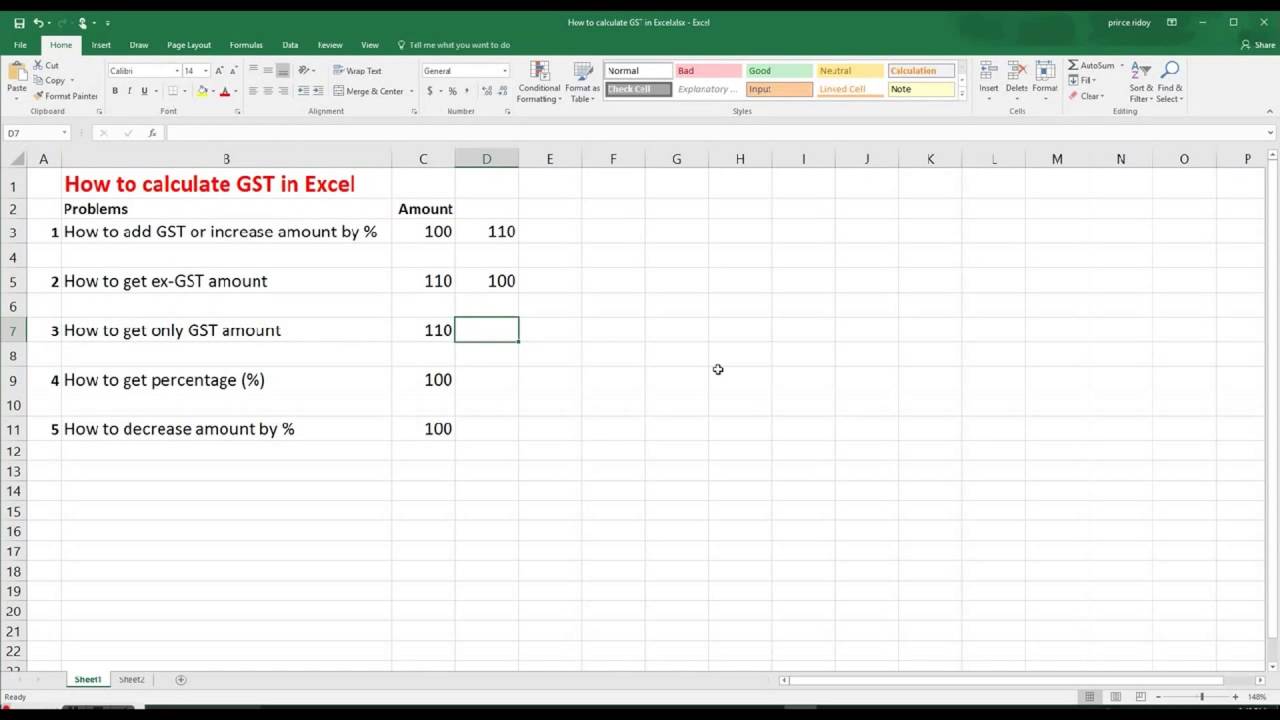

History of HST implementation in Canada. Enter Price Add Or Subtract HST from the price. This Excel tutorial shows different techniques to calculate and find GST amounts.

In this example sales tax is 10000 minus 9259 or 741. The regular method formerly called the general method requires that you keep track of the GST and HST collected from each business transaction. If youre not a formula hero use Paste Special to subtract in Excel without using formulas.

Subtract the pre-tax price and the general sales tax from the total price. Enter your name and email in the form below and download the free template now. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value.

Amount without sales tax x HST rate100 Amount of HST in Ontario. For example say you sold 10000 worth of hot food and the sales tax on hot food is taxed at 8 percent. Subtract The Tax Paid From The Total.

In other words if the sales tax rate is 6 divide the sales taxable receipts by 106. Please enter a numeric value in the Amount. Subtract the dollars of tax from step 2 from the total price.

Subtract the total receipts from the ending figure from step 3 to calculate the amount of tax owed on the department receipts. Divide the bill for the goods or services by one plus the GST. This also helps you do some practice in Excel------Please watch.

To find the total including GST simply add the two values together. In the example below B5 has been multiplied by 015 which is the same as 15. Right click and then click Paste Special.

To do this you simply multiply the value excluding GST by 15 or by 015. You can type either value into. GST Inclusive Price X 3 23 GST Amount.

Select the range A1A6.

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Complete A Canadian Gst Return With Pictures Wikihow

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Is Being Charged Gst Hst Tax For The Free Games That Come With A Gpu Normal Bapccanada

Reverse Hst Calculator Hstcalculator Ca

Sale Prices Taxes And Total Cost Youtube

Quick Method Of Hst Collection Madan Ca

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Calculate Hst Collection Process Real Case Excel File Uber Drivers Forum

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Mathematics For Work And Everyday Life

How To Calculate Sales Tax In Excel

Sales Tax In Canada Hst Gst Pst When You Re Self Employed

If The Total Amount Is Rs 2065 Including The Gst 18 Then What Is The Actual Price Quora

Mathematics For Work And Everyday Life

How To Calculate Sales Tax In Excel

Quick Method Of Hst Collection Madan Ca

Mathematics For Work And Everyday Life